$2000 Gold Price 'Takes a Breather' after Near-Record Comex Surge

$2000 Gold Price 'Takes a Breather' after Near-Record Comex Surge

Monday, 10/30/2023 14:40

by Atsuko Whitehouse is the Head of the Japanese Market at BullionVault and the Editor of Japanese GoldNews.

-----

The GOLD PRICE edged lower, rallied and then edged back below $2000 once again on Monday after reaching that level for the first time since mid-May in the final hours of Comex futures and options trade last week as Israel widened its ground offensive in Gaza but remained more cautious than many analysts had expected, writes Atsuko Whitehouse at BullionVault.

With the US Federal Reserve expected to hold its key interest rate at near 2-decade highs this Wednesday, the gold price hit new all-time highs in most major non-Dollar currencies – including the Chinese Yuan, Euro, British Pound and Japanese Yen – ahead of tomorrow's Bank of Japan decision and then the UK's Bank of England on Thursday.

The US Treasury Department will also announce its quarterly bond sales plan this week, wary of how its announcement in August – when it set a plan to borrow $103 billion of longer-term securities the following week – spurred the sell-off in US government debt which has since sent longer-term interest rates surging up to multi-year highs.

"Time for a breather, I feel," says bullion-market analyst Rhona O'Connell at brokerage Stone X Group Inc.

"The hue and cry a couple of weeks ago when [gold] bounced up as of 7th October [the day of Hamas' atrocities across southern Israel] was in my view a bit overdone...I still think [the gold price is] consolidating and building a base for further gains, subject to geopolitics."

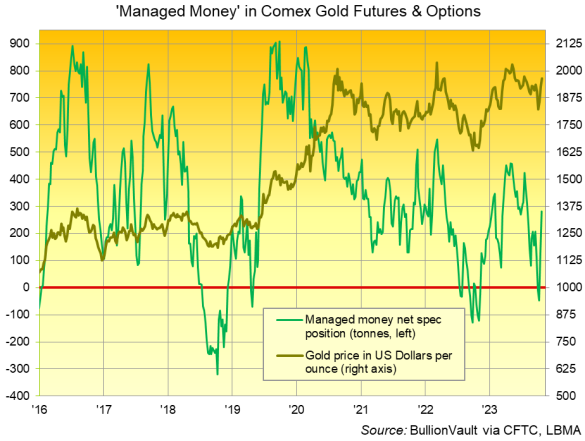

Ahead of last Friday's late spike to a $2000 gold price, hedge funds and other leveraged speculators in Comex gold futures and options grew their bullish positions by 22% from a week earlier, while cutting their bearish bets as a group by 26%.

Overall, that pushed the net long position of Managed Money traders 117% higher to the largest since the beginning of August, according to positioning data from US regulators the CFTC for the week-ending last Tuesday.

It also meant speculators as a group bought the notional equivalent of 328 tonnes of gold in just two weeks, the second fastest fortnightly pace on the CFTC's near 2-decade records.

"It is too risky to start a new gold short from here, as there is still potential for upside," says Bruce Ikemizu, chief director of the Japan Bullion Market Association in his latest market note.

In contrast to Comex derivatives, gold-backed ETF trust funds saw further liquidation last week, with the giant SPDR Gold Trust (NYSEArca: GLD) and the iShares gold ETF (NYSEArca: IAU) shrinking by 0.2% and 0.5% from the previous Friday despite holding unchanged in size going into the weekend.

iShares' giant silver ETF trust (NYSEArca: SLV) also did not change in size Friday, growing 0.4% for the week.

The price of silver, which finds nearly 55% of its annual demand from industrial uses, rose 1.3% today to $23.40 per Troy ounce after falling 3.9% last week.

Oil prices slipped more than 1% on Monday, cutting 1/3rd of Friday's jump on news of Israel stepping up its ground incursion into Gaza.

European stocks rose 0.7% on the Euro Stoxx 600 index after hitting 10-month lows – on course for a 4.6% monthly fall – as the Euro and UK gold price in Pounds per ounce edged back from the weekend's new all-time highs at €1901 and £1658.

The gold price in Japanese Yen also slipped on Monday after hitting a fresh all-time high at ¥9661 per gram, while the gold price in China – the precious metal's No.1 consumer nation – touched a new record of ¥480 per gram at Monday morning's Shanghai benchmarking auction.