China to offer platinum (and palladium) stockpile data as market tightens

China to offer platinum stockpile data as market tightens

Bloomberg News | November 13, 2025 | 6:30 am Markets China Platinum

The Guangzhou Futures Exchange will publish details of platinum and palladium stockpiles when it launches China’s first derivatives market for the precious metals, offering a rare insight into demand.

![]() The exchange, which last week won approval to host China’s first futures market for the metals, will issue a daily update of the warehouse inventories on warrants that underpin physically settled contracts, according to people familiar with the matter, who asked not to be identified because they are not authorized to speak publicly.

The exchange, which last week won approval to host China’s first futures market for the metals, will issue a daily update of the warehouse inventories on warrants that underpin physically settled contracts, according to people familiar with the matter, who asked not to be identified because they are not authorized to speak publicly.

While metal bought and sold on the bourse will account for only a portion of China’s total trade in platinum and palladium, the inventories will provide a valuable glimpse into supply and demand trends in one of the world’s biggest markets. Currently, no official data exists on platinum and palladium stockpiles in China, although the Shanghai Gold Exchange offers spot contracts for platinum. Stockpiles of metal not traded on the exchange will not be publicly available.

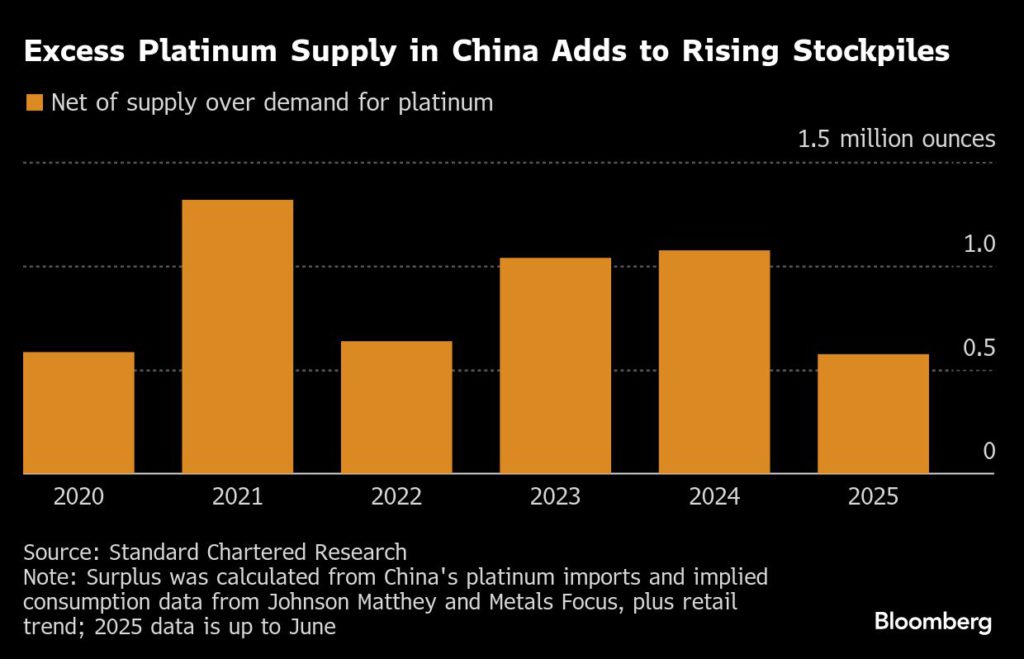

Platinum, also used in catalytic converters to cut vehicle emissions, has risen nearly 80% in value this year, outperforming even gold. A years-long supply crunch has been exacerbated by tariff fears that funneled large volumes of the metal to US warehouses, and by Chinese imports that have outpaced estimates of domestic consumption. With China producing little platinum of its own and exerting strict control over exports, every ounce that enters the country sucks some liquidity out of the global market.

The new contracts “will improve transparency in the domestic market,” said Deng Weibin, regional head of Asia Pacific at the World Platinum Investment Council, an industry organization. He estimated that futures trading would go live in a few weeks, though no date has been announced. The Guangzhou Futures Exchange declined to comment.

It’s not just China where platinum stockpiles are a mystery to investors. The London market is also without publicly available inventory data, in part because so much of the material is held in granule or powder form in the private vaults of a few specialist market makers. That’s unlike gold and silver, which are primarily held in bar form in the vaults which underpin the market, and for which monthly inventories are published.

While inventory data are available for facilities linked to the New York Mercantile Exchange, metal there is accepted only in cast plates or ingots. The new Chinese contracts will also accept metal in powdered or sponge form — making Guangzhou the first exchange to allow delivery of sponge, a typical form for industrial use.

Strong Chinese demand for platinum has put a strain on the London market. In particular, purchases accelerated last month before the Nov. 1 removal of a long-standing tax rebate enjoyed by China Platinum Co., a state-owned trading house. Tim Murray, director of precious metals management at Johnson Matthey Plc, said “a significant amount of metal” was shipped into China ahead of that deadline.

The rush to obtain physical metal pushed up prices and lease rates, with sky-high borrowing costs making it challenging to trade. “I’ve been around this for about 36 years, and never seen anything sustained like this in platinum,” Murray said during the London Bullion Market Association’s annual gathering last month in Japan.

Industrial demand for platinum in China is expected to supplement investment buying, further depleting stockpiles. Slower-than-expected adoption of electric vehicles – meaning demand for fuel-powered cars, and the platinum in their catalytic converters, has stayed higher for longer – is contributing to the drawdown.

Given the high cost of borrowing platinum, Murray said, industrial consumers who have been rolling over leases in the metal may eventually decide to purchase their platinum outright. This would lead prices to rise further.

Meanwhile, the launch of the Guangzhou contracts will offer arbitrage opportunities in a market that has already attracted a slew of speculators this year, said Deng from the investment council. “More investors will turn attention to dynamics in China, which in turn increases China’s influence on international prices,” he said.

(By Yihui Xie, Annie Lee and Jack Ryan)

Read the full article here: China to offer platinum stockpile data as market tightens - MINING.COM