Gold price craters in worst decline since 80s, silver drops 36%

Gold price craters in worst decline since 80s, silver drops 36%

Staff Writer | January 30, 2026 | 8:19 am

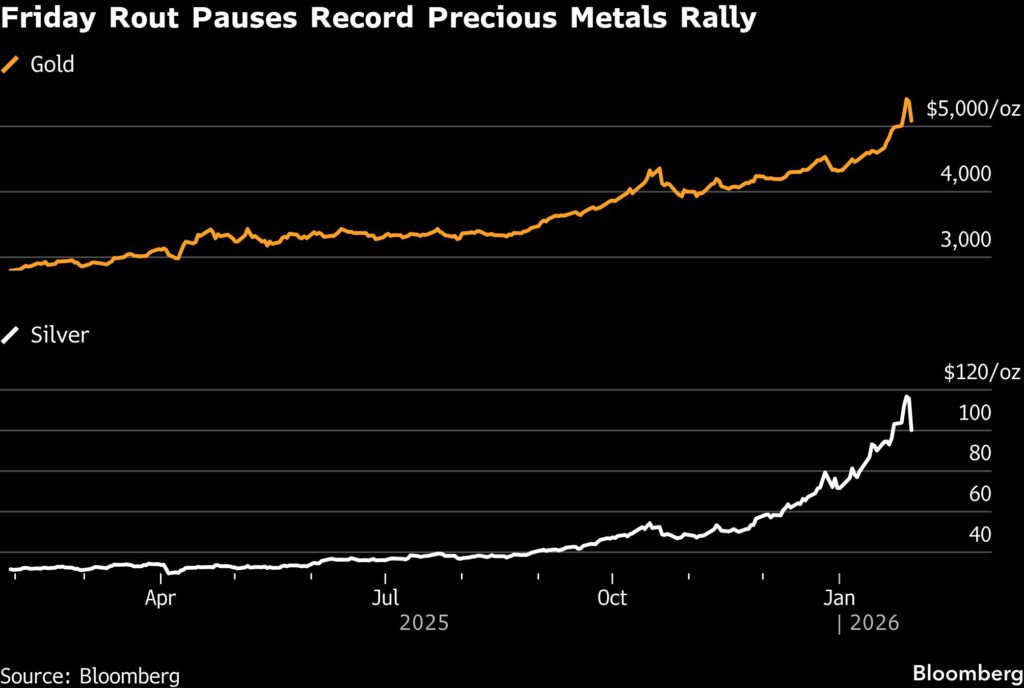

Gold and silver prices both cratered on Friday as investors looked to book profits on the metals, which have rallied to record highs in recent weeks.![]()

Gold futures dropped as low as $4,700 an ounce before recovering some of those losses in afternoon trade only to succumb again to some late selling. Gold for delivery in April, the most active contract, closed at $4,745 an ounce down 11.4% or $600 an ounce on the day. It was the biggest intra-day decline since the early 1980s.

As has become the norm, silver took even wilder swings with the metal down more than $40 an ounce or 35% to $74 an ounce around midday. The metal pared some of those losses but towards the end of trading suffered another bout of heavy selling to end the day at $78.53 an ounce, a 35.9% drop and the biggest decline on record. Palladium slid by 15% to $1,700 an ounce while platinum gave up 17% to $2,178 an ounce.

Precious metals have been rallying relentlessly to begin the year, with gold peaking at nearly $5,600 an ounce and silver above $121 an ounce earlier this week.

The declines follow a historically volatile session on Thursday, where the metals suffered a similar downswing and then U-turned back up.

The downward move began during overnight trading after reports came out that the Trump administration plans to nominate Kevin Warsh as the next Federal Reserve chair, which it confirmed on Friday.

Even before the Fed chair nomination, the metals have already been primed for extreme moves, as soaring prices and volatility strained traders’ risk models. A record wave of purchases of call options also mechanically reinforced “upward price momentum,” Goldman Sachs said in a recent note.

Meanwhile, US equities continued to slide on the Warsh pick, given his hawkish stance in the past. Traders’ hopes for rate cuts were dealt another blow on Friday after a hotter-than-expected producer price report.

Due for correction

While reports of Warsh’s nomination were a trigger, a correction was overdue, said Christopher Wong, a strategist at Oversea-Chinese Banking Corp., noting that this “validates the cautionary tale of fast-up, fast-down” nature of the moves seen in gold and silver.

“It’s like one of those excuses markets are waiting for to unwind those parabolic moves,” he added.

The extent of the correction “suggests that market participants were simply waiting for an opportunity to take profits after the rapid price rise,” analysts at Commerzbank AG also wrote in a note Friday.

Still, while rumours of Warsh’s appointment may have triggered the fall, there is a high probability that the Fed “will yield to pressure to at least some extent and cut interest rates more than is currently priced in by the market,” they added.

Warning signs

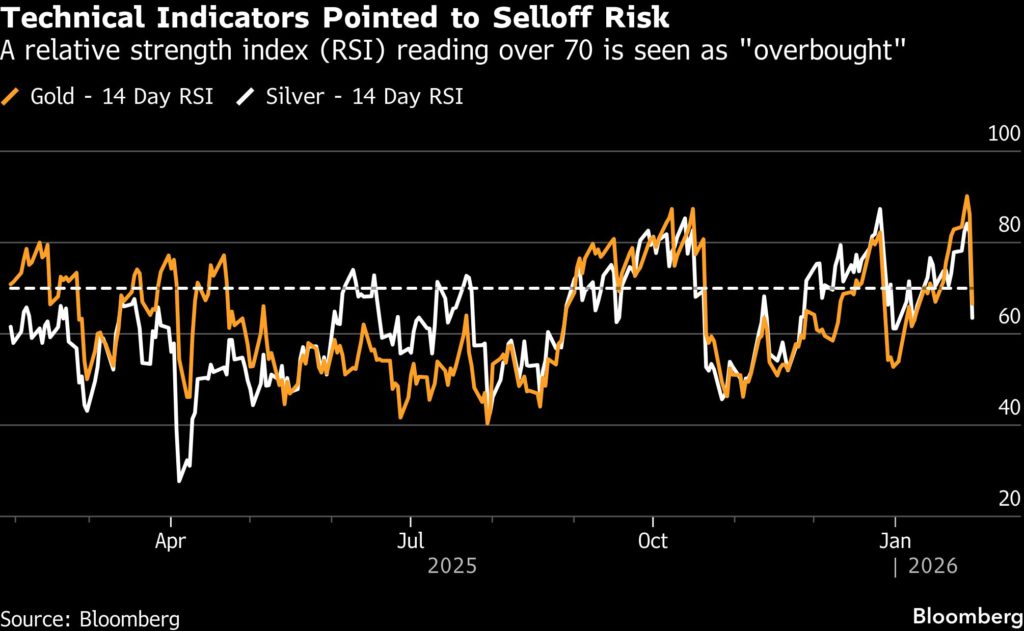

According to Bloomberg analysis, some technical indicators have been flashing warning signs. One is the relative-strength index (RSI), which in recent weeks signaled that the metals may have become overbought and due a correction. Gold’s RSI recently hit 90, its highest in decades.

“The silver/gold ratio has climbed almost as much as it did in the late 1970s, and today’s dramatic moves show that might have marked a rejection point. Gold and silver separately, however, so far never quite matched their 1979 rallies,” Bloomberg macro strategist Simon White wrote.

Read the full article at: Gold price craters in worst decline since 80s, silver drops 36% - MINING.COM