Yields spike and gold shrugs: What’s driving bullion now?

Yields spike and gold shrugs: What’s driving bullion now?

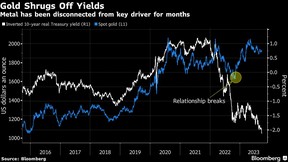

Unravelling of relationship between gold and real interest rates could be a paradigm shift

Bloomberg News

Eddie Spence and Yvonne Yue Li

Published Sep 25, 2023 • Last updated 2 hours ago • 4 minute read

What determines the price of gold? For much of the past decade, the answer was easy: the price of money. The lower rates fell, the higher gold climbed, and vice versa.

Gold is the quintessential “anti-dollar” — a place to turn for those who distrust fiat currency — so it seemed natural that prices would rise in a world of low real interest rates and cheap dollars. Or when rates went up, gold, which pays no yield, naturally became less attractive, sending prices tumbling.

Well, not anymore.

As inflation-adjusted rates soared this year to their highest since the financial crisis, bullion has barely blinked. Real yields — measured by the 10-year United States Treasury inflation-protected securities (TIPS) — jumped again on Sept. 21 to their highest since 2009, while spot gold nudged down a mere 0.5 per cent the same day. The last time real rates were this high, gold was about half the price.

Read the full article at: Yields spike and gold shrugs. What’s driving bullion now? | Financial Post