Recycled Platinum Supply Outlook - CME Group

Recycled Platinum Supply Outlook

By World Platinum Investment Council - WPIC®

07 MAY 2024

The opinions expressed in this report are those of World Platinum Investment Council (WPIC) and are considered market commentary. They are not intended to act as investment recommendations. Full disclaimers are available at the end of this report. This report was first published 27 February 2024

Executive summary

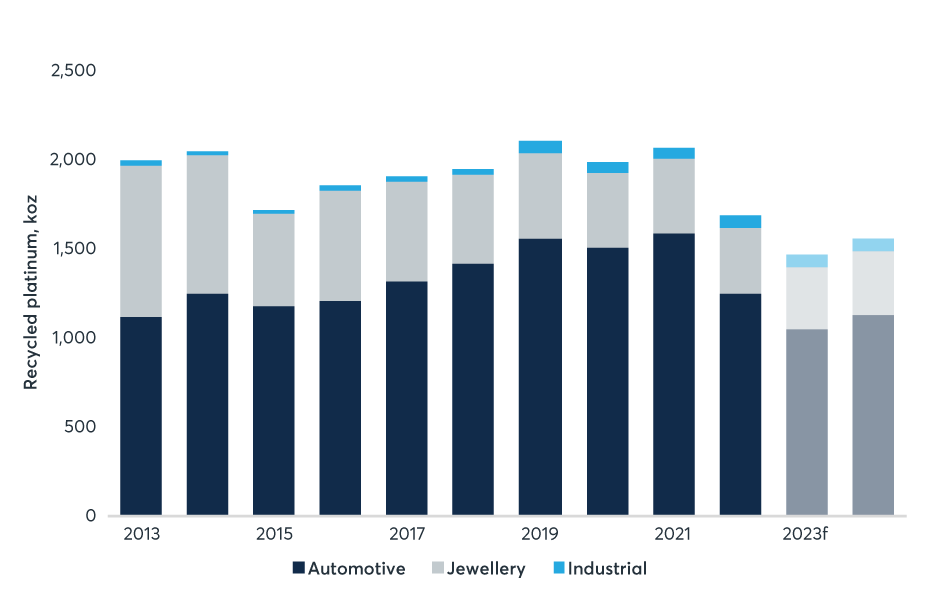

Recycling is an important secondary source of platinum supply, accounting for approximately 25% of total annual supply. By far the most significant source of recycled platinum supply – around 80% – comes from spent autocatalysts in end-of-life vehicles (figure 1).

Figure 1: Recycled autocatalysts are the by far most significant source of recycled platinum supply

Between 2021 and 2023 recycled platinum supply decreased by 30%. Recycled platinum supply declined by 14% year-on-year (-245 koz) in 2023 to 1,495 koz, due to factors including a shortage of end-of-life vehicles and other issues within the scrap supply-chain that are currently considered to be relatively short term.

While recycled platinum supply is forecast to recover by 7% in 2024 to 1,600 koz this is nevertheless 17% below the -year average and there are several downside risks associated with this outlook.

The platinum market has entered a period of sustained deficits, with WPIC’s quarterly supply and demand data demonstrating that a deficit of 878 koz occurred in 2023, with a second consecutive deficit of 418 koz forecast for this year. Beyond 2024, WPIC’s most recent Two-Five-Year Supply/Demand Outlook indicates further latinum market deficits continuing each year through 2028. Sustained recycling challenges could deepen platinum supply/demand deficits.

Overview of trends in recycled platinum supply

Platinum recycling supply remained consistent between 2013 to 2021 (figure 2), averaging around 2,000 koz each year. The trends during that period were increasing automotive recycling offsetting declining jewellery recycling. Increasing automotive recycling was a function of scrapped end-of-life vehicles having progressively higher PGM loadings due to historical tightening of emissions limits.

Figure 2: Platinum recycling supply 2013 – 2024f

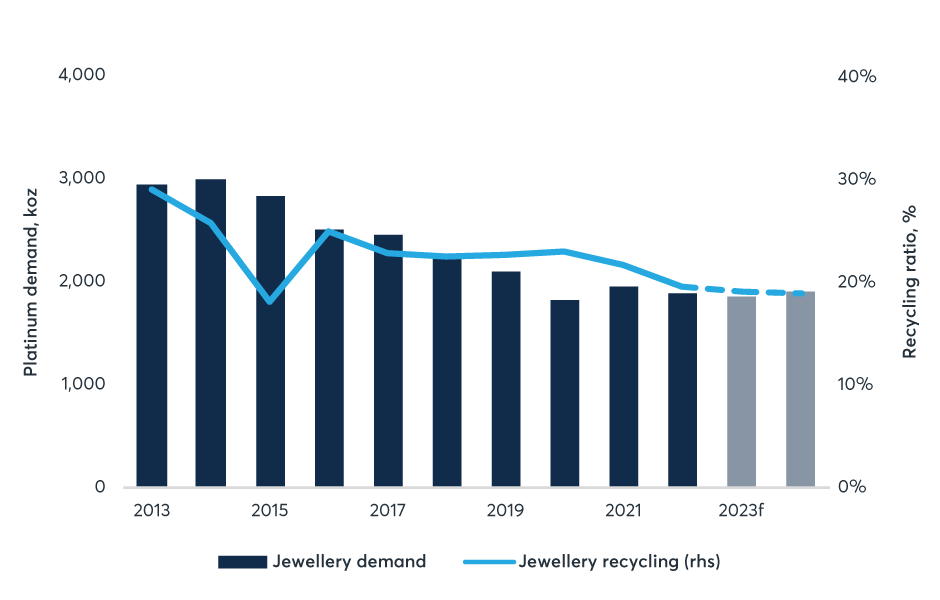

Shrinking jewellery recycling stemmed from lower platinum jewellery demand resulting in fewer trade-ins of old jewellery (figure 3).

Figure 3: Platinum recycled jewellery supply 2013 – 2024f

However, recycled platinum supply decreased by 30% between 2021 and 2023. In 2023 it fell 14% year-on-year (-245 koz) to 1,495 koz, the lowest level since the WPIC began publishing supply and demand data a decade ago and 25% below the preceding five-year average, weighed down by a second year of depressed supply from the autocatalyst recycling market and – to a lesser extent – a further decline in recycling supply from platinum jewellery.

Factors impacting recycled autocatalyst platinum supply

In 2023 recycled autocatalyst platinum supply dropped 17% (-223 koz) year-on-year to 1,076 koz, with several factors at play.

Since 2021, there has been a major cut to automotive recycling. Lower scrap automotive supply was initially attributed to suppressed new vehicle production due to disruptions associated with the pandemic and the ensuing semiconductor shortage, with a lack of new vehicles forcing consumers to run existing vehicles for longer before trading them in for a new model. However, new light-duty vehicle production recovered from below 80M units in 2020 and 2021 to over 90M units in 2023, and yet automotive recycling supply continued to shrink. Additionally, stock that is available is more frequently from older vehicles with autocatalysts that have lower PGM loadings or where the PGMs are coated on difficult-to-smelt substrates.

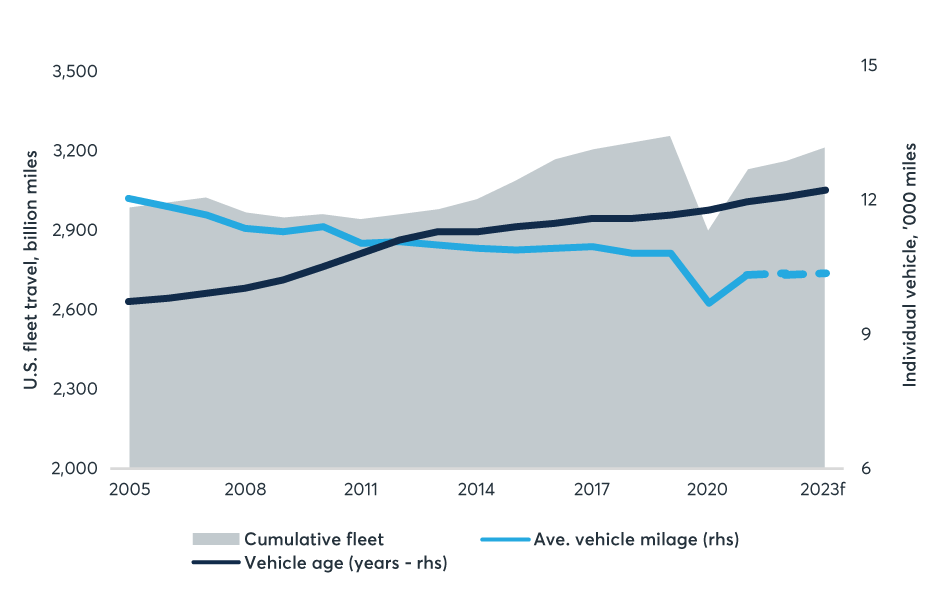

Recycled autocatalysts are taking longer to reach recyclers due to extended vehicle ownership, caused by:

- Lifestyle shifts, with the emergence of work-from-home practices having reduced annual vehicle mileage by around 5% on average (figure 4).

Figure 4: Vehicle age growth-has accelerated, with changing consumer behaviours such as work-from-home reducing annual mileage by 5%

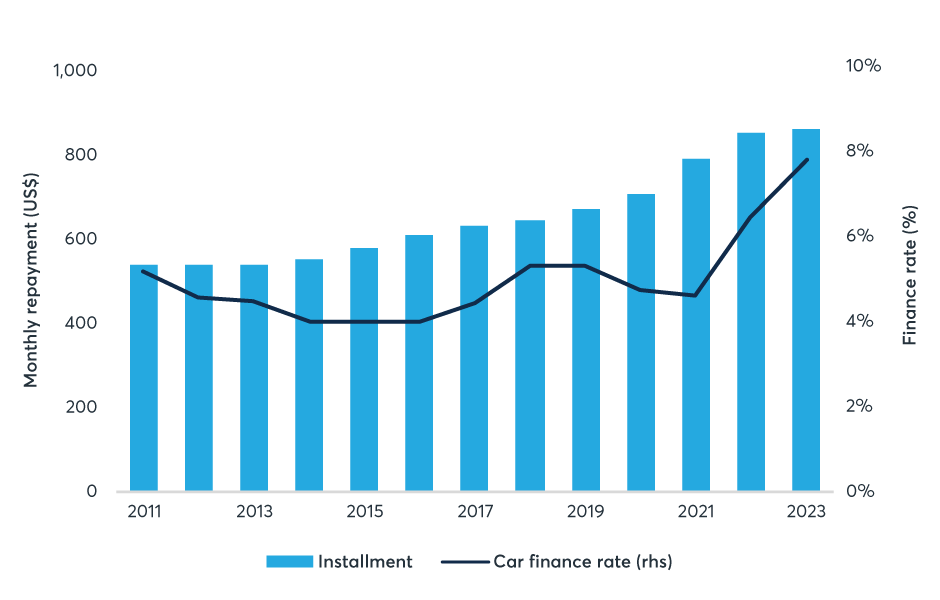

- A deterioration in vehicle affordability due to higher new car prices and the impact of a higher interest rate environment on finance costs (figure 5).

Figure 5: Monthly car repayments have increased by 22% since 2020 due to both higher interest rates and underlying car prices

In the US, measures to curtail autocatalyst theft have also impacted recycling supply in recent months, as have restrictions on autocatalyst recycling recently enacted in China. Further, a weak PGM basket prices is also deferring the supply response, with recyclers reportedly hoarding spent catalysts in anticipation of future PGM price recovery.

Outlook for recycled platinum supply

While platinum recycling supply is forecast to improve 7% year-on-year (+105 koz) to reach 1,600 koz in 2024 after two years of steep declines, it will remain 17% below average -year recycled supply. However, with the expected recovery skewed towards the end of the year, there are risks to this outlook.

Supply from spent autocatalysts is expected to grow 9% (+91 koz) to 1,167 koz as supply-chain challenges ease. In the jewellery scrap market, a 3% (+10 koz) increase is forecast. This is mainly due to a modest recovery in new jewellery demand increasing sellbacks. The growing focus on governance and policy formulation for the recycling of e-waste has led to a forecast 4% (+3 koz) increase in the recycling of electronic scrap for this year.

Should recycling headwinds continue to prevail in 2024 and beyond, sustained recycling challenges could lead to an ongoing reduction in secondary platinum supply, deepening forecast platinum supply/demand deficits. WPIC estimates that, under these circumstances, projected platinum deficits from 2025-2027 could deepen by around 300 koz each year. By the same token, the Palladium market could take longer to enter the market surplus that is forecast to occur from 2025 (figure 6).

Figure 6: A continuation of the platinum recycling headwinds post-2023 could deepen the platinum deficit and prolong a palladium market deficit

Source: SFA (Oxford) 2013 to 2018, Metals Focus 2019 to 2024f, platinum 2025-2027 and palladium 2023-2027 WPIC Research

Read the full article at: Recycled Platinum Supply Outlook - CME Group